new law for debtors in uae

2023-11-07There have been several legal and economic changes in the United Arab Emirates in recent years. One prominent development is the issuance of a new law concerning debtors in the UAE.

Today, in our article titled new law for debtors in uae, we will delve into the important details surrounding this topic.

Do you need legal consultation dubai regarding the new law for debtors in UAE? click here to contact with our law firm.

new law for debtors in uae.

Since January 2020, the new bankruptcy law has been implemented in the United Arab Emirates in full. This law protects creditors in Dubai and other emirates from legal proceedings.

One of the key changes that came with the new bankruptcy law is that financial commitments of debtor collections are no longer deemed a criminal offense.

This means that individuals facing debts in Dubai and other emirates can benefit from a debt restructuring plan lasting for three years, by local legislation

The new bankruptcy law in Dubai provides an opportunity for individuals and companies to restructure their debts sustainably and emerge from the financial crisis they are facing.

This law is considered an important measure to adapt the legal system to the financial burdens that individuals and companies are experiencing due to ongoing economic changes.

To enhance our understanding of the new legislation in Dubai, we can look at how Emirati citizens facing debts can benefit from it.

These individuals can utilize these laws to restructure their debts and establish a customized repayment plan to help them deal with their outstanding debts.

Settlement of financial obligations

The court will appoint one or more specialists to assist debtors throughout these proceedings and develop a settlement plan for their financial obligations based on their circumstances. after the strategy is established, creditors will cast their votes and put it into action.

The court has the authority to refuse or terminate the debt settlement process in the following cases:

- If the debtor refuses to surrender, intentionally damages, or conceals some or all of their assets.

- If the debtor provides false statements regarding their obligations, financing, or rights.

- If the debtor furnishes inaccurate information about their responsibilities, funding, or entitlements, or if the debts remain unpaid for a duration surpassing 40 consecutive business days due to financial challenges, the debtor has the option to initiate bankruptcy proceedings.

Key provisions of the new debtor’s law

The proposed legislation aims to protect debtors from facing legal consequences, remove the criminalization of financial obligations for those who have declared bankruptcy, and provide them with opportunities to work, contribute, and support their families.

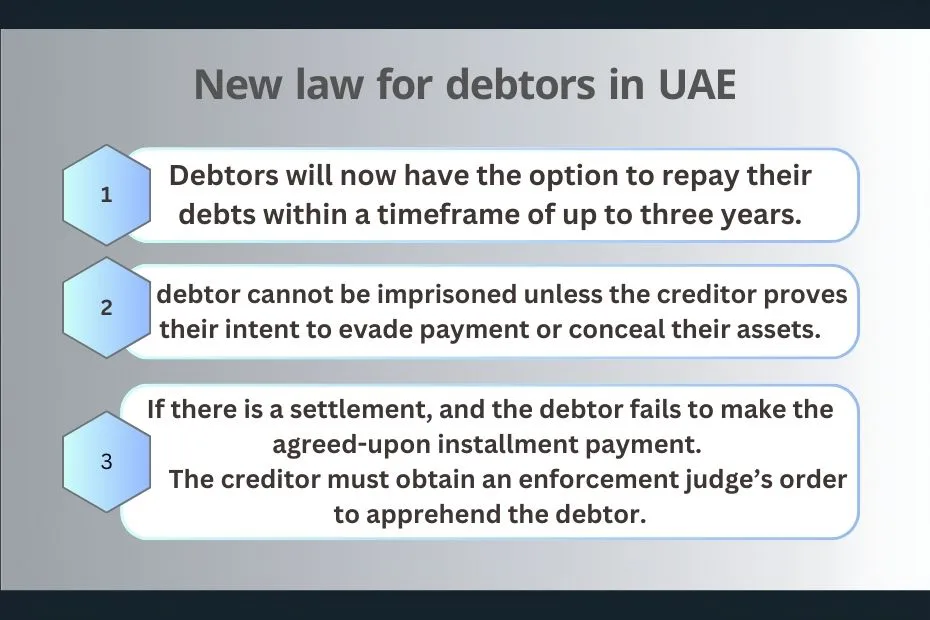

Remarkably, debtors will now have the option to repay their debts within a timeframe of up to three years.

A debtor cannot be imprisoned unless the creditor proves their intent to evade payment or conceal their assets.

If there is a settlement between the creditor and the debtor, and the debtor fails to make the agreed-upon installment payment. the creditor must obtain an enforcement judge’s order to apprehend the debtor, prompting an initial procedural investigation.

FAQs

Here are answers to some of the most important questions regarding the new law for debtors in uae:

In our article titled new law for debtors in uae, we discussed financial obligations settlement and provided many important details about debtor collection.

we hope that we have provided you with all the information you need regarding the subject of our article. and if you need any legal consultation regarding any issue or lawsuit, you can contact Al-Shamsi Law Firm for legal services and consultation.

we recommand you to read: penalty for unpaid debts in dubai UAE, and no imprisonment for debt dubai. presented by Best criminal lawyers in abu dhabi.

مستشار قانوني لديه إجازة في القانون وله أبحاث ومقالات قانونية عديدة تم نشرها في أهم المجالات العالمية التي تعنى بالشأن القانوني. مثل:

– مجلة الندوة للدراسات القانونية.

– المجلة الدولية القانونية.

– مجلة العلوم السياسية والقانون.

كما له عدة دراسات لحالات وقضايا في تخصصات مختلفة: كالقانون الدولي, القانون الجنائي, قانون المعاملات المدنية, قانون المعاملات التجارية وغير ذلك.